I’m good with numbers. Why, just the other day Dianne had some reason to need to know how much 16 times 12 was. I answered before she could even find her calculator. It’s 192.

It’s easy. Sixteen times ten is 160 and two times 16 is 32. Add them together and you get 192. See?

I’m also not half bad at reading. I read at my grade level, whatever that is when you’re 66-years old.

And still, with all of these powerful skills, I find my income taxes befuddling. I get them wrong pretty much every year. Around about June I may get a check or more likely a bill with a penalty. It’s never a lot of money one way or another, so it’s not worth it to me to figure out what I did wrong. I just cash the check or meekly pay my debt to society and move on with my life.

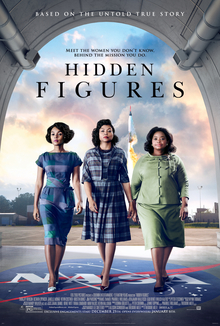

What usually messes me up is just one number: trying to figure out how much of our Social Security income is taxable. The answer is pretty much all of it, but that’s not good enough for the IRS. Oh no. Figuring this out is like making the mathematical calculations that got men to the moon and back. I need hidden figures to figure out my figures.

This year I just said ‘to hell with it’ and made an estimate based off of last year. I know. I know. I’ll hear from the IRS in June. I’ll pay my debt to society and move on, unless I underestimated how much is exempt, in which case I’ll cash the check and use the proceeds to buy myself a round of golf.

But here’s the point to my story (there is one, I promise). I am the straightest arrow there ever was. I don’t hate the IRS. I don’t hate the federal government. I don’t hate paying my taxes. I want to get it right. I usually want to dot every i and cross every t. And yet this system has got even a solid citizen like me openly flouting the law. Now, it’s true that I may have flouted the law in a way that has me paying a little more than I owe in taxes, but still this system has me feeling like Jesse James.

Why is the whole thing so damn complicated? Because we try to do too much with our tax code. Because we’re trying to use the tax system to influence human behavior — encouraging some activities while discouraging others — we’ve made the whole thing incomprehensible. This is the original sin of our tax code, and if we just gave up on this fool’s errand we’d all be a lot better off.

You want to know what I’d do? No? Well, I’m going to tell you anyway. I’d get rid of the whole crummy Byzantine system and replace it with two things: a federal sales tax and a simple flat income tax.

Before my liberal friends explode in chants of “Tax the Rich! Kill the One Percent!” let me make a case that this will actually be more fair than what we have now.

Most of those Western European welfare states fund their programs through sales taxes. These taxes don’t have to be all that regressive if you tax everything. The problem with our Wisconsin state sales tax is that the base isn’t broad enough. We provide exemptions based on the power of special interests at the Capitol. So, we exempt most services and if you’re a heavy user of, say, lawyers and accountants you get a big break because those services aren’t taxed. I wouldn’t have any exemptions at all — not even for food or clothing. That’s because once you take a step down that road, special interests will quickly join you on it. And because they can afford lobbyists, the end result will be a less progressive and less fair system.

Same goes for income taxes. Complexity plays to the advantage of those who can work the system — those who can afford tax lawyers and accountants. So, what we might lose in apparent progressivity, we’ll make up for in real progressivity. What if we had an across-the-board federal tax rate of 20%, excluding the first $50,000 in income? Just take what you earned last year — regardless of the source — subtract $50,000 and multiply by .2. That’s it. No itemizing. No standard deductions. No forms. No tables. Simple.

So if you make $50,000, you owe no income tax. If you earn $100,000, half your income is tax free. If you made a million dollars, 95% of your income is taxable. That’s progressive. It’s true that the millionaire’s income may not be taxed at a higher rate, but I’ll trade that for all of the smoke and mirrors that might result in millionaires getting off nearly scot free.

Of course, the exact percentages of income and sales taxes would depend on what’s needed to pay for stuff. But that’s another thing. The percentages should be adjusted every year to match the revenue needed to produce a balanced budget. It would be simple and transparent. Here’s what it costs to run the government and here’s what your share is. You think that’s too much? Okay, so what do you want to cut?

The current system breeds contempt and the perception — if not the reality — of unfairness, simply because it’s so opaque. Simplicity has rewards that far outweigh any benefit from any tax loophole designed to engineer some sort of social or economic behavior.

Like most Americans, I just want to pay my damn fair share and be done with it. All I want to know is how much I owe.

On this website we believe in:

Free speech.

The rule of law.

Reason.

Tolerance.

Pluralism.

Do you still do your taxes on paper? If so I would think paying for good tax software would be a small price to pay for your peace of mind.

We were forced to learn the “times tables” in elementary school so I’m good up to 12×12.

Your idea, or something like it, has the best chance of happening under Trump. If it doesn’t happen now it will never happen.

LikeLike

Why do you think simplifying tax filing has its best chance under Trump? I just read Trump-Musk plans to eliminate the Direct File system, which already greatly simplified tax filing and was started during the Biden administration. I used it this year, and it was the easiest and quickest filing taxes has ever been for me.

So, Trump claimed in his first term that he’d simplify tax filing, but didn’t. There was tangible progress simplifying tax filing under Biden. Now Trump-Musk is indicating that the progress made through Direct File will be rolled back. Why is Trump is still your best hope for this?

LikeLike

Didn’t know about the end to direct filing; this article is good:

https://www.sfgate.com/news/politics/article/trump-administration-plans-to-end-the-irs-direct-20279346.php

Anyway my comment, and Dave’s column was about simplifying the tax code, not simplifying filing. Changing the tax code is bringing KAOS (IYKYK) to the IRS. Better chance under Trump.

In a related note, the company Palantir sued the US government or maybe just a branch of military for not observing a rule that says if software is available from private companies the government can’t build its own version. Palantir won. Maybe that rule doesn’t apply to tax filing, or no one has had the guts to sue.

LikeLike

Well, well. We agree 100%. Why do you think this current administration isn’t trying to make that happen?

LikeLike

I could not agree more with this. I get the point of progressive taxation and the intent at its origin meant well and I fault no early 20th century progressives (especially those named LaFollette) for coming up with the idea. Our tax code has gotten way too complicated and much of it, as you say, is to push for some social outcome. It is time to simplify, taxation is not that hard and “regressive” applies to people who want to take our country back to McKinley, it does not accurately apply to a national sales tax to fund social programs or a flat income tax to prevent cheating with loopholes.

LikeLike

The whole tax system is way above my pay grade, so I have a professional do our taxes, I’d rather pay for peace of mind than face the terror group known as the IRS.

LikeLike