In my last blog I made the assertion, quoting the center-right columnist and editor Jonah Goldberg, that the rich were already paying their fair share in taxes. Goldberg claimed that the top 10% of income tax filers paid three-quarters of federal income taxes.

An alert reader took issue with my overall assertion and provided data to back up his counter argument. I share it without further comment below:

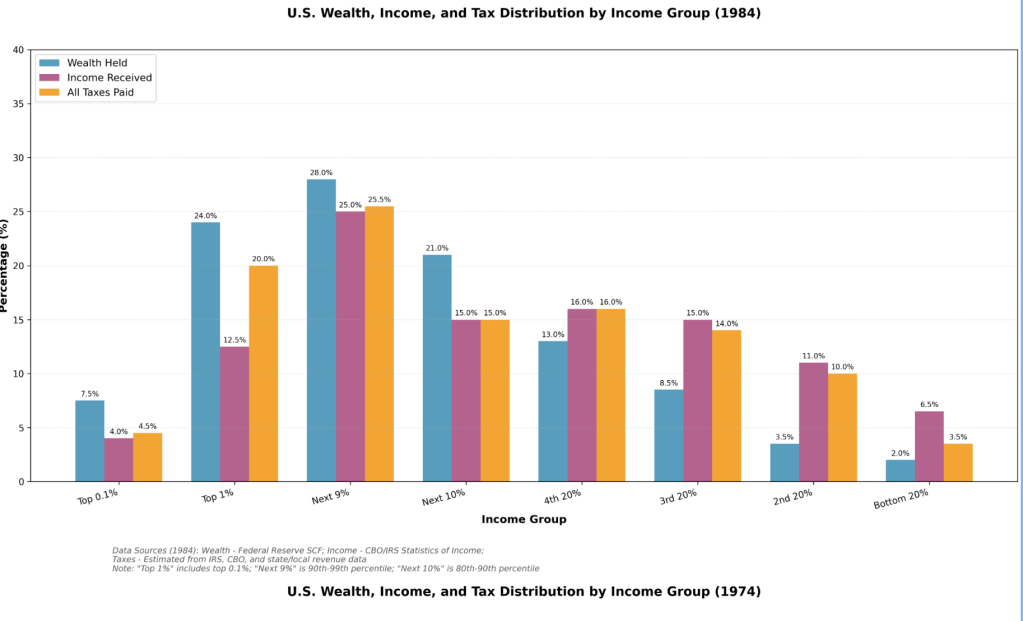

The historical figures reveal a dramatic 70-year trend of increasing inequality:

Top 1% wealth concentration has increased steadily from 20.5% (1954) to 32% (2024)—a 56% relative increase. The acceleration was sharpest during the 1980s-1990s, coinciding with tax cuts and financial deregulation.

Bottom 20% wealth share has collapsed from 3.0% (1954) to just 0.5% (2024)—an 83% decline. Their income share also fell from 8.0% to 5.0%, while their tax burden remained roughly proportional, meaning they pay about the same rate as the middle class despite far lower resources.

The inflection point appears around 1974-1984, when inequality began accelerating after decades of relative stability. This corresponds to the end of Bretton Woods, stagflation, and the policy shift toward deregulation and supply-side economics.

The middle quintiles (2nd, 3rd, 4th) have also seen steady erosion in their wealth and income shares, with the gains concentrated not just in the top 1% but particularly in the top 0.1%, whose wealth share roughly tripled from ~5.5% to 14% over this period.

the problem is the incompetence of the Left in terms of providing good government spending. they cannot articulate any redistribution because they put the dollars into the wrong places. For my part, as a state legislator I suggested Dems should stand for collapsing all major safety net discretionary spending into a cash benefit system akin to basic income proposals. It would operate like a Social security for under age 62 working persons, and use technology to calculate income, tax obligation, and mega EITC cash payment to assist people –poor but working to pay for housing, food, health, etc. Gone would be federal, state, county welfare employees micromanaging these programs like Food share, child care, section 8, TANF, etc. Gone is the humiliation of needing to apply for a program just because you work and don’t have much money. I did the math, and you can save hundreds of millions in bureaucracy. (my colleagues told me I was useless, crazy) Things like education and infrastructure have such thick layers of rent seeking, they are no longer the magic wand of govt spending in terms of outcomes. This is one reason Biden failed so miserably: he touted big infrastructure projects, built by Republican contractors, union skilled trades who routinely bolt from the Dem Party over its social issue woke garbage. Especially when you use borrowed money, spending on infrastructure does nothing to help inequity or jumpstart the economy. Govt regulations and workforce shortages cause price tag on infrastructure to skyrocket and take forever to complete, erasing any economic stimulus. More cash to subsidize the inefficient, expensive ACA? That does not fix the problem…oh yeah, on that note: where is the Left response to the ACA shortfalls of premium hikes, high out of pocket limits, and otherwise complicated process. Sure Bernie has Medicare for All, which is no template for saving money. Maybe someone with brain cells and charisma, could come up with a model different than fee for service and complex HMO, PPO networks, for profit hospital systems, for profit health insurance (see Jim Doyle on that one).

LikeLiked by 1 person